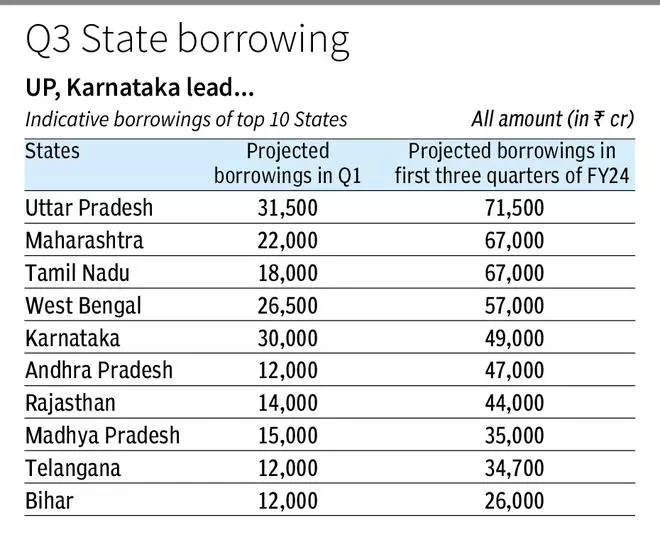

Uttar Pradesh and Karnataka are projected to make the highest market borrowings in the third quarter of FY24. According to the Reserve Bank of India’s indicative borrowing calendar, Uttar Pradesh has projected a market borrowing of ₹31,500 crore in October-December quarter, while Karnataka is planning to raise ₹30,000 crore.

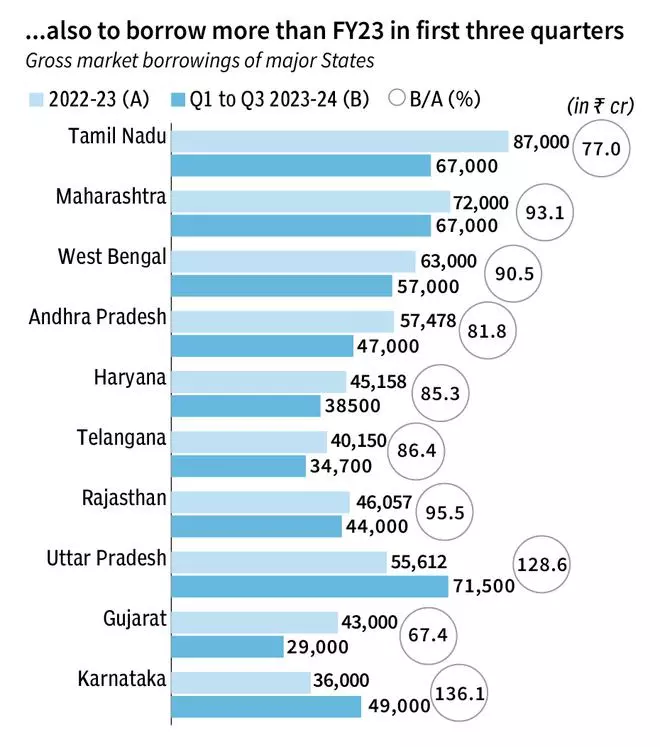

Interestingly, the projected market borrowings of these two States in the first three quarters of the current fiscal have even exceeded their full year actual borrowings in FY23. For instance, Uttar Pradesh has projected a market borrowing of ₹71,500 crore for the April-December period, which is 130 per cent of its actual market borrowings in the previous fiscal.

Similarly, Karnataka’s borrowing projection in the first three quarters has exceeded its FY23 total borrowings by ₹13,000 crore or 36 per cent. Karnataka, which saw a new Congress government in May, projected nil market borrowing in Q1. However, the State’s market borrowing rose to ₹19,000 crore and ₹30,000 crore in the second and third quarters.

States such as Maharashtra, Rajasthan and West Bengal are all likely to exceed 90 per cent of their previous year’s borrowing at the end of third quarter. Election to the Rajasthan Assembly is likely to be held by the end of 2023. This could be the reason why the State is going full throttle on borrowings.

fiscal deficit

States raise funds through market borrowings to finance their fiscal deficit (excess of expenditure over revenues). State market borrowings are through the issue of bonds under State Development Loans (SDLs). Market borrowings typically account for over 75 percent of their total borrowing. The remaining deficit is funded from loans from the Centre.

On a consolidated basis, Uttar Pradesh tops the list of States with highest market borrowings in the first three quarters at ₹71,500 crore, followed by Maharashtra and Tamil Nadu, which have projected ₹67,000 crore each. Among the top 10 States, Telangana has the lowest borrowing projection in the first three quarters at ₹34,700 crore.

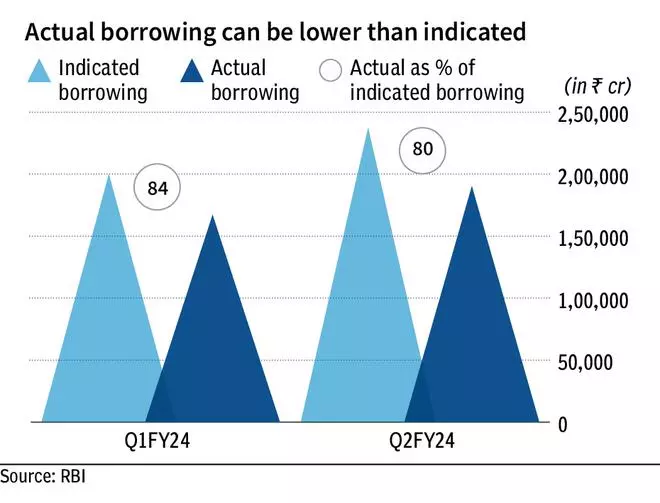

It is worth noting that the figures are only indicative in nature, and States may overshoot or borrow less than their projection, according to the actual requirement. For instance, the combined market borrowing projections of all States and Union Territories stood at ₹1.99-lakh crore. However, they ended up borrowing only ₹1.67-lakh crore. In Q2 FY24 also, States and UTs borrowed only 80 per cent of the projected ₹2.37-lakh crore.